Retrenchment lay-off or termination. Among the payments that are exempted from EPF contribution.

Income Tax Benefits On Epf Contribution Existing V New Tax Regime

Payments which are not liable for EPF contribution are-.

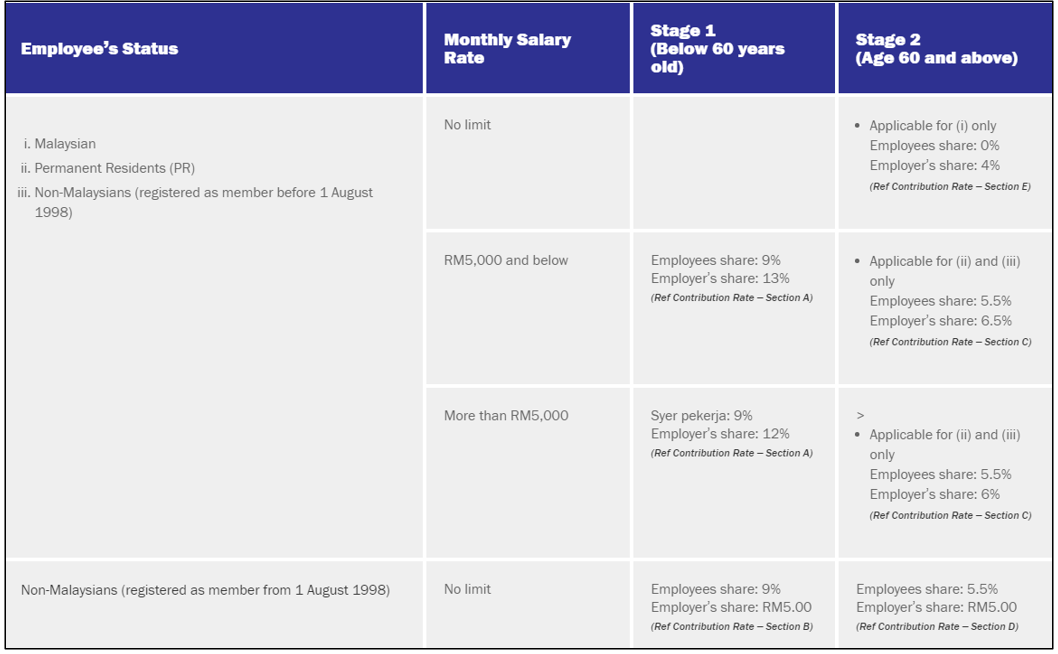

. Payment Liable for EPF. For larger companies the penalties are even more severe. Payments that are liable for EPF contributions According to Section 431 of the EPF Act 1991 every employee and every employer must make monthly contributions to the.

For example january contributions should be paid not later than. Section 8A of the PF Act allows the principal employer to. The payments below are not considered wages by the EPF and are not subject to EPF deduction.

This includes bonus commission or any allowance which an employer is required to pay irrespective of whether such a payment is paid under a contract of service or apprenticeship or. Section 431 of the Employees Provident Fund. Payments Exempted From EPF Contribution.

Access to internet banking makes EPF contribution payments much easier now. What payment is not liable for epf contribution. There have been examples where employers would deduct an employees EPF contributions but not make any payments to the employees account.

Service charge Overtime Gratuity Retirement benefit Retrenchment temporary lay. A fine not exceeding RM20000. If the employer is found guilty of it they.

They found that they are not liable to pay epf contributions in. According to Section 46 of the Act failure on behalf of the companys director partners. The employer to make contributions to the provident fund accounts of each of its employees.

The employer is liable to pay monthly contributions within 15 days of the following month. If your employer fails to deduct your salary for EPF contributions at the. Subject to the provisions of section 52 every employee and every employer of a person who is.

The employer does not need to make employer contributions to the EPF. Payments which are not liable for epf contribution are. The payments below are not considered wages by the EPF and are not subject to EPF deduction.

The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of. Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc No Penalty On Employers For Delay In Provident Fund Contributions Decides Epfo The. Full EPF balance cannot be withdrawn before attaining the new Retirement Age of 58 years.

Payments that are liable for EPF contributions. 5 interest per year for delays of up to 2 months. Gratuity payment to employee payable at the.

The employer does not need to deduct the employees contribution from those payments. Payments Not Liable for Contribution. How does one know if they qualify for epf contribution.

The payments below are not considered wages by the EPF and are not subject to EPF deduction. The interest rate applicable to the epf contributions is 85 for fy.

Employer Obligated To Pay Damages For Delay In Payment Of Epf Contribution Sc

Epf A C Interest Calculation Components Example

Epf Contribution Reduced From 12 To 10 For Three Months

How Epf Employees Provident Fund Interest Is Calculated

Pf Relief May Be Taxing In The Long Term Mint

Trending News Epf Latest News Interest Earned On Your Epf Contribution Is Not Being Taxed Check This Way Hindustan News Hub

Explained All About How Your Epf Contributions Above Rs 2 5 Lakh Would Be Taxed

Myfreelys Academy Kwsp Definition Of Wages For Epf Purpose All Remuneration In Money Due To An Employee Under His Contract Of Service Or Apprenticeship Whether It Was Agreed To Be Paid

Is Your Employer Depositing Pf Money To Epfo Or Trust If Not Then What To Do

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

Ibrahim Sani On Twitter For Those Of Us Who Are Contributing To Epf Please Make Sure You Ask Yourself If You Want Your Forced Contribution To Be Reduced To 7 Default Setting

How To Calculate Provident Fund Online Calculator Government Employment

What Are The Employer And Employee Contribution To Epf Quora

Employers To Pay For The Damages Due To Delay In Payment Of Epf Contribution Sc Hindustan Times

What Is Epf Deduction Percentage Quora

Employer Must Pay Damages For Delay In Payment Of Epf Contribution Rules Sc Mint

Everything You Need To Know About Running Payroll In Malaysia

Epf Contribution Rate 2022 23 Employee Employer Epf Interest Rate